santa clara property tax due date 2021

County of Santa Clara Department of Tax and Collections 70 West Hedding Street East Wing 6th Floor San Jose California 95110-1767 SECURED PROPERTY TAX BILL TAX YEAR. Should you be currently living here.

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

Get email reminders that your taxes are due.

. January 22 2022 at 1200 PM. With our resource you will learn helpful facts about Santa Clara property taxes and get a better understanding of what to anticipate when it is time to pay. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property.

The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax bills to all property owners at the address shown on the tax roll. Business Property Statements are due April 1. First installment of taxes due covers July 1 December 31st.

The due date to file via mail e-filing or SDR remains the same. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due. The Department of Tax and Collections in.

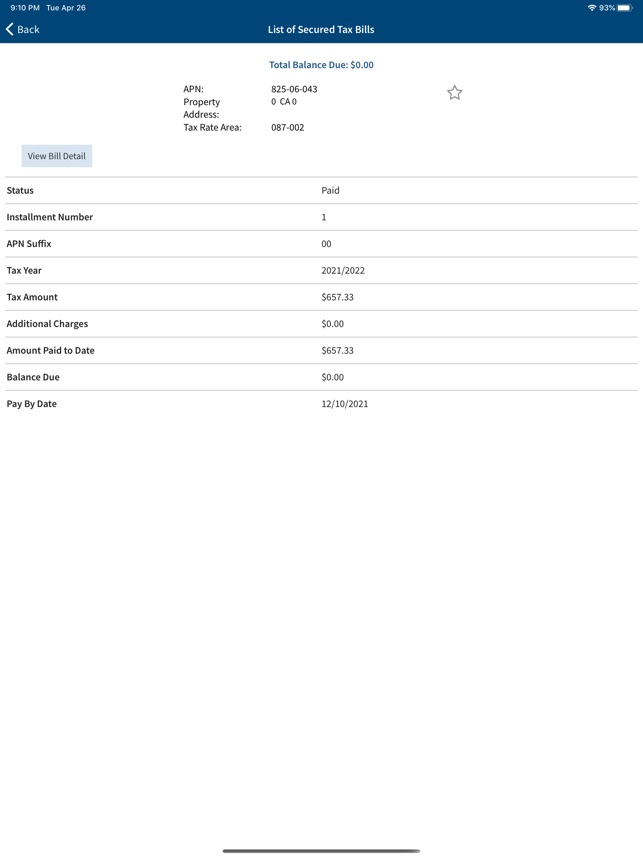

Last Payment accepted at 445 pm Phone. 022-32-009 TAX BILL INFORMATION. Look up prior years bills and payments.

2021-2022 for July 01 2021 through June 30 2022 ASSESSORS PARCEL NUMBER APN. SANTA CLARA COUNTY CALIF. SANTA CLARA COUNTY CALIF The Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2020-2021 property.

SECURED PROPERTY TAX BILL TAX YEAR. Taxes due for July through December are due November 1st. If they are not paid by.

MondayFriday 800 am 500 pm. The fiscal year for Santa Clara County Taxes starts July 1st. Pay your Property Tax bill online.

Review property tax bills any place with an internet connection. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the. Thursday Nov 10 2022.

The Property Tax online viewpay system will be unavailable from 500 PM - 530 PM on November 14 2022 due maintenance. Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April. SANTA CLARA COUNTY CALIF.

The County of Santa Clara Department of Tax and Collections DTAC has mailed out the 2021-22 property tax bills to all property. Payments are due as follows. Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners.

If Date falls on Saturday Sunday or Legal Holiday mail postmarked on.

Property Taxes Department Of Tax And Collections County Of Santa Clara

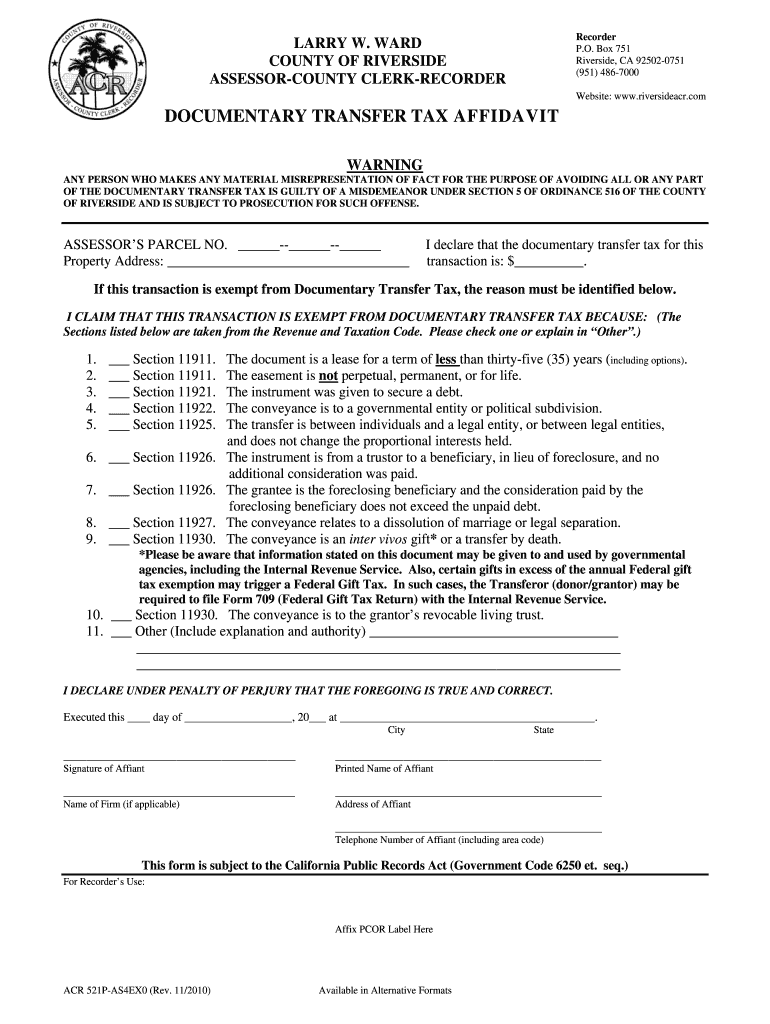

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

The County Of Santa Clara Department Of Tax And Collections Reminds Property Owners That The Second Installment Of The 2020 2021 Property Taxes Is Due By County Of Santa Clara California Facebook

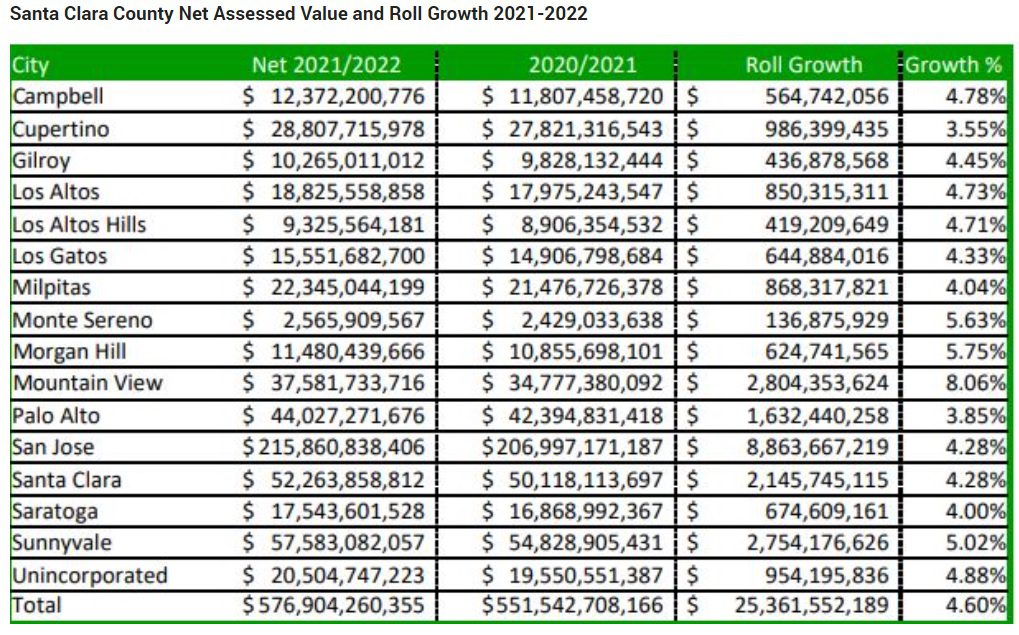

How Has Prop 13 Affected Tax Distribution In Santa Clara County San Jose Spotlight

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Scam Alert County Of Santa Clara California Facebook

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

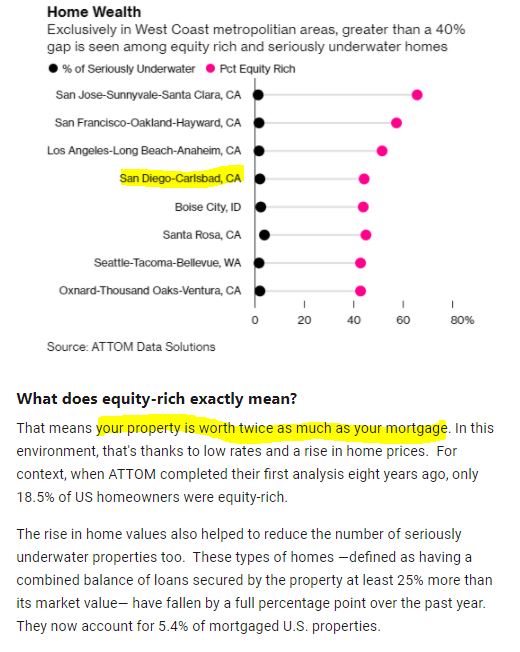

Property Tax Re Assessment Bubbleinfo Com

Property Tax California H R Block

Payment Information For Santa Clara County Property Tax Due Dates

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Prop 19 Property Tax And Transfer Rules To Change In 2021

Santa Clara County Property Taxes Due Date Ke Andrews

Santa Clara County Pledges Housing First Mindset In Nationwide Homelessness Initiative

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Transfer Tax Affidavit Fill Out Sign Online Dochub

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

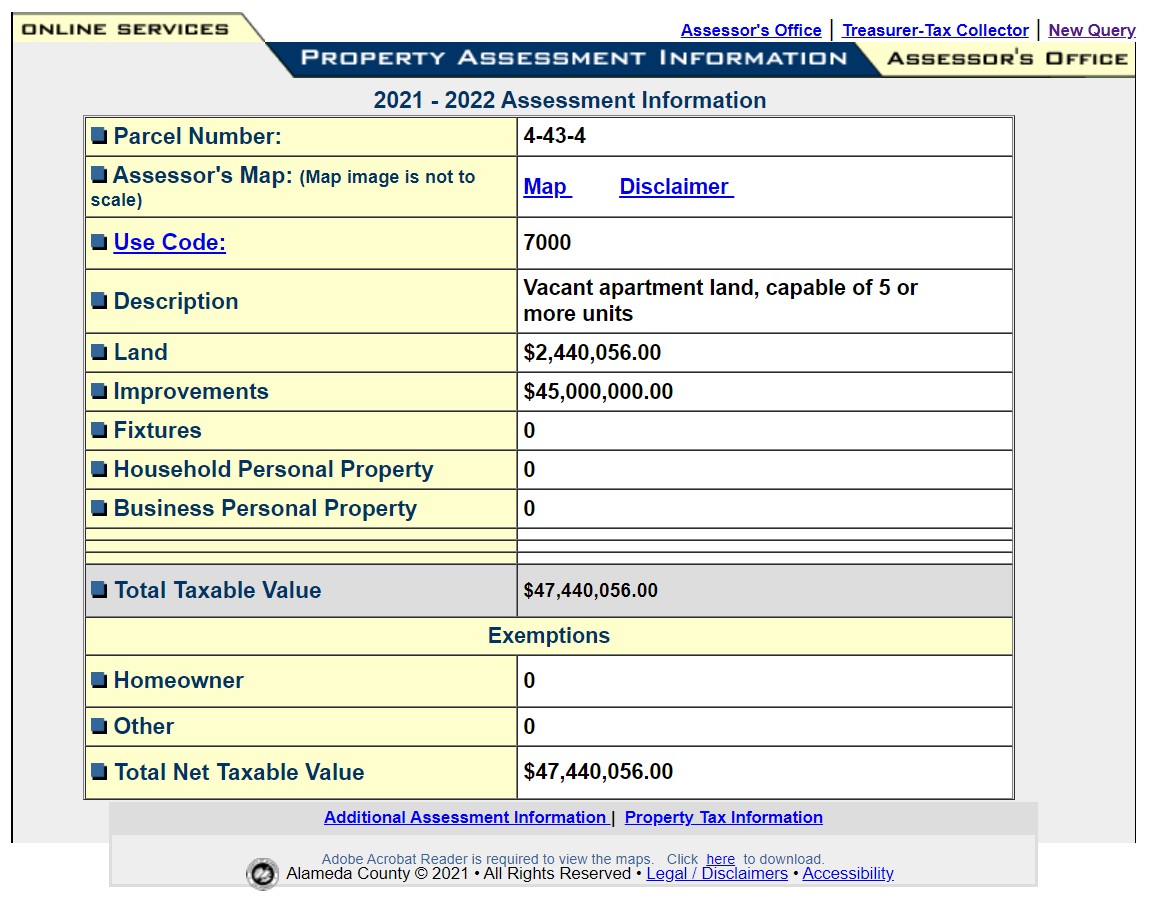

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates